By Lewis Holly. Last Updated 19th September 2022. Welcome to our guide on the topic of making a claim for a fatal car accident. There are many different types of personal injury claims that can be made. In this article, we will tell you how you can claim on the behalf of a loved one who had suffered a fatal injury in a car accident. This can be a road traffic accident in which they were the driver, a cycling accident or a passenger on public transport.

Fatal car accident claims guide

A fatal accident may not necessarily result in the victim’s death at the scene of the incident. It could also be that they pass away at a later date due to their injuries.

If you have any issues or queries, please do not hesitate to get in touch with us. Once we know more about the circumstances surrounding the claim, we will be able to offer you more accurate information and guidance.

You can contact us by:

- Calling us using the number at the top of the page

- Using the pop-up chat window in the corner

- Visiting our contact page

Choose A Section

- What Is A Fatal Car Accident?

- Who’s Eligible To Claim Under The Fatal Accidents Act 1976?

- Limitation In Fatal Accident Claims

- Fatal Car Crashes In The UK – What Evidence Will I Need To Make A Claim?

- Compensation Awards For Death

- No Win No Fee Agreements And Fatal Car Accident Claims

- Learn More About Making A Claim After A Fatal Car Accident

What Is A Fatal Car Accident?

A fatal car accident is when a road user is injured to such a severe extent that they pass away as a result. The Fatal Accidents Act 1976 states that certain qualifying relatives can make a claim on the behalf of a loved one following their wrongful death.

In order to claim, you must show that a third party breached a duty of care that they owed you. There are two main parties that owe you a duty of care in relation to road traffic accidents:

- The local council has a responsibility to maintain the roads. This is set out in the Highways Act 1980. If they fail to do this and you’re injured in an accident that happens as a result, you may be able to claim.

- Other road users have a duty of care towards you to act in a way that reduces the risk of injury. The ways that road users are expected to act is set out in the Highway Code.

If this duty of care is breached and someone passes away as a result of negligence, then you could claim on their behalf if you’re a qualifying relative.

Statistics On Fatal Car Accidents

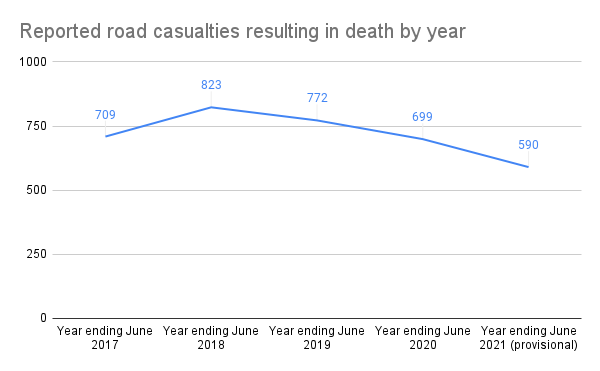

This section of our fatal car accident claims guide focuses on statistics regarding how common deaths on the road are.

As you can see from the graph below, fatal road traffic accidents are not an uncommon occurrence. The reported road fatalities for the year ending June 2021 came to 1,390. This marks an 11% increase since 2020.

However, these statistics do not state how many of these fatal accidents were the result of negligence. Therefore, there is no insight on how many of these incidents could result in successful personal injury claims.

Who’s Eligible To Claim Under The Fatal Accidents Act 1976?

Section 1 of this act states that there are a number of qualifying relatives that could make a fatal car accident claim if they have lost someone due to negligence. This list includes a:

- Wife/husband

- Civil partner

- Cohabiting partner (for at least 2 years)

- Dependents (such as children)

If the deceased never married or entered a civil partnership, then their parents can make a claim if their child was legitimate. In some cases, a partner of the deceased can make a claim for their death even if they didn’t live together beforehand, provided that they didn’t live together because of infirmary or ill-health. Siblings and other members of the deceased extended family can also make a claim in some cases.

If you are unsure as to whether your relationship with a departed loved one makes you eligible to make a claim, get in touch with us today. One of our advisors could connect you with a No Win No Fee solicitor from our panel.

Limitation In Fatal Accident Claims

The time limit for making a claim is 3 years from the date of death. This is stated in the Limitation Act 1980. The time limit dictates that you must have started a claim within this time window.

However, there can be certain circumstances where this time limit could possibly be extended. For example, if the relevant qualifying relative is a child, they cannot pursue their own claim. Therefore, the

If you’re unsure as to whether you’re within the time limit to make a claim for a fatal car accident, get in touch today.

Fatal Car Crashes In The UK – What Evidence Will I Need To Make A Claim?

Under the Road Traffic Act 1988, fatal car crashes in the UK should be reported to the police as soon as possible if the other driver did not stop and exchange insurance details, you have reason to believe the incident was a criminal act or the accident has resulted in an obstruction in the road.

Police reports can also be used as evidence in a fatal car accident claim, as they are likely to investigate the incident and have some idea of who was liable.

You could also consider collecting the following evidence:

- CCTV footage or dash cam footage as video evidence can show who was responsible for causing the accident

- The contact details of any witnesses who are willing to give an account of events

- Coroner’s reports contain information on the cause of the victim’s death and what their injuries were

- Receipts or invoices that show related financial losses

The more evidence you have that a road user has neglected their duty of care, resulting in the death of your loved one, the more likely you are to receive a payout for a fatal accident.

Our panel of solicitors could help you gather evidence for fatal car accidents in the UK. Get in touch with our advisors for a free consultation at any time.

Compensation Awards For Death

There is a payment known as general damages that can apply to certain fatal accident claims. This figure is awarded to acknowledge someone’s physical and mental suffering caused by their injuries. It’s calculated by legal professionals with the assistance of a publication called the Judicial College Guidelines (JCG).

The amount would be awarded to the dependents or spouse/partner making the claim on behalf of the deceased.

The JCG was last updated in 2019 and is made up of various entries that describe injuries and what they could be worth. A fatal car accident could result in the victim suffering for a period of time before passing away. Their dependents could inherit this sum once their loved one is deceased.

We’ve included some example entries from the JCG in the table below. The awards have been taken directly from the publication. However, the amount that’s awarded can be more or even less than what is stated. This depends on the severity of the case in question.

Injury Description Amount

Death (with full awareness) (A) When injuries such as burns/lung damage with a short period of fluctuating consciousness for a number of weeks. Intrusive treatment followed by death in a period between a couple of weeks and 3 months £11,770 to £22,350

Death (unconsciousness, followed by death) (B) Injuries that cause pain of an excruciating nature that’s followed by a loss of consciousness after 3 hours, followed by death 2 weeks later £9,870 to £10,010

Death (Unconcious immediately, then death) (C) When injuries cause immediate unconsciousness and the injured party passes away after 6 weeks £3,530 to £4,120

Death (Unconcious immediately, death soon after) (D) Injuries that cause instant unconsciousness, or unconsciousness shortly after and death follows within 1 week £1,290 to £2,620

In addition to the compensation that covers the pain and suffering of the deceased, a qualifying relative could make a claim if they were financially dependant on the deceased. This will be worked out based on how long the dependant would have been financially dependant on the deceased.

Whilst it may not fall under the bracket of special damages, you may even be able to claim for a sum to assist in covering funeral costs.

Is It Possible To Get A Bereavement Award?

A bereavement award, which is also known as a bereavement support payment (BSP) is a flat sum that can be awarded to the spouse or relative(s) of a loved one.

A BSP can only be awarded to:

- The deceased’s spouse or civil partner

- The cohabiting partner of the deceased (where they had been living with the deceased for 2 years before the incident as husband or wife or civil partner of the deceased)

- A parent of the deceased, where the deceased was an unmarried minor

This is a separate sum from general and special damages. It is applied for through the government website. The amount that would be awarded, if successful, is currently £15,120. This is stated in Section 1A of the Fatal Accidents Act 1976.

If there is more than one person applying for a BSP then they would not receive £15,120 each. The payment would be divided between them.

For more information on the process of making a claim for a bereavement payment, speak with one of our advisors. You could be connected with a No Win No Fee solicitor from our panel to work on your claim.

No Win No Fee Agreements And Fatal Car Accident Claims

All of the lawyers on our panel can offer representation on a No Win No Fee basis. This means that, as their client, you won’t need to pay their fees if your claim is unsuccessful. You also won’t be asked to make a payment upfront or while the fatal car accident claim is being worked on.

If you are awarded a settlement, then your lawyer will be paid in the form of a small percentage taken from the final amount before it reaches you. This percentage is kept small by law. This way, the majority of the compensation is protected.

You can make a claim without legal representation, but we don’t recommend it. Having a legal professional to assist you can make the process less stressful and easier to understand. They can also advise you on collecting evidence to prove your personal injury claim.

So, get in touch today if you want to make a claim on a No Win No Fee basis for a fatal accident. We can tell you if your claim is valid and possibly even connect you with a lawyer from our panel so we can get you started.

You can:

- Call using the number at the top of the page

- Use the pop-up chat window in the corner

- Fill out the form at the bottom of our homepage

Learn More About Making A Claim After A Fatal Car Accident

We’ve included some additional links on the topic of this and related subjects.

- An NHS guide on the topic of brain death.

- Government advice on what to do after a death.

- Another article from the NHS regarding grief and loss.

We also have a bunch of guides on personal injury claims which you can read below:

- Road Traffic Accident Claims

- All You Need To Know About Road Traffic Accident Claims

- How Can Cycling Accident Solicitors Help Me?

- Car Accident Personal Injury Claims Guide

- Could I Get Compensation After An Accident On A Bus?

- How To Claim For An Accident On Public Transport

- I Had An Accident On Public Transport, Can I Make A Claim?

- What Goes Into Making a Taxi Accident Claim?

- How To Make A Passenger Injury Claim After An RTA

- Making A Car Accident Claim Guide

- Bike And Cycle Accident Personal Injury Claims

- How Long Do Car Accident Claims Take To Complete?

- How To Find Solicitors For Car Accident Claims

Thank you for reading our guide on whether you can make a fatal car accident claim.

Written by Bib

Published by Sto